Managing and reconciling invoices in an organization is a crucial yet labor-intensive task. Keeping track of suppliers, their outstanding payments, and payment timelines can consume significant time and energy. Fortunately, with AI tools, the burden of invoice management can be significantly reduced, enabling focus on more strategic tasks.

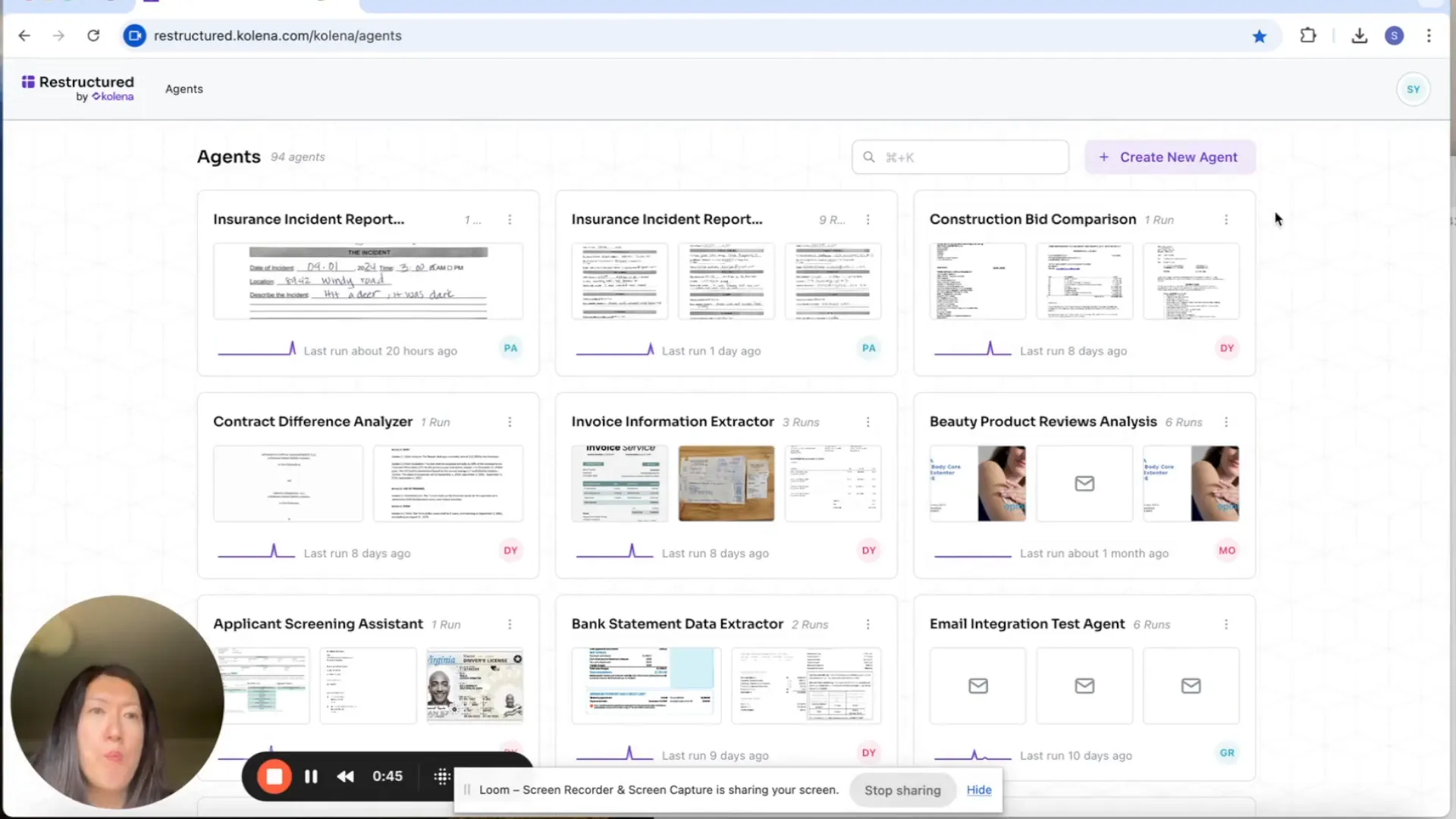

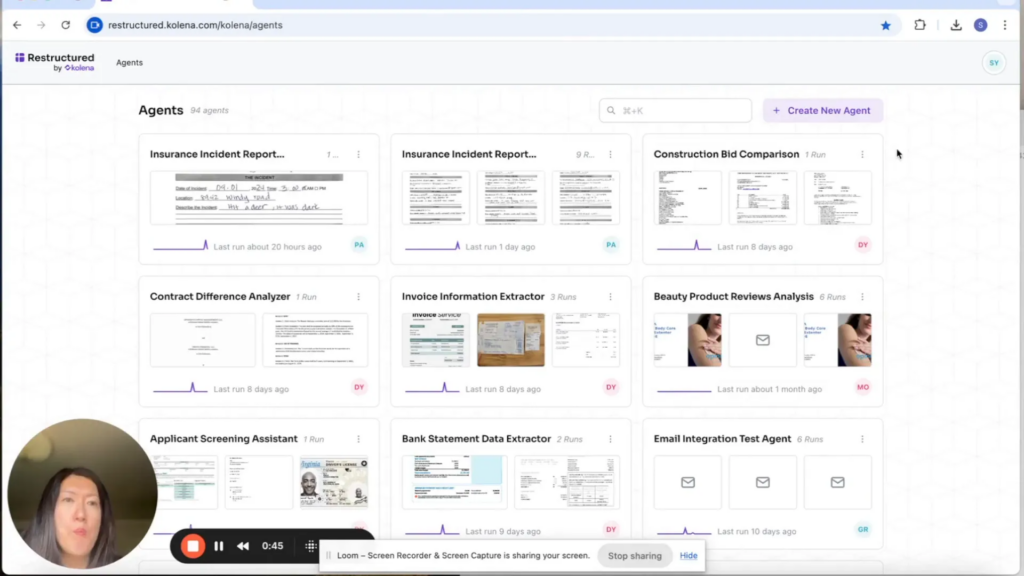

Introducing the AI Agent

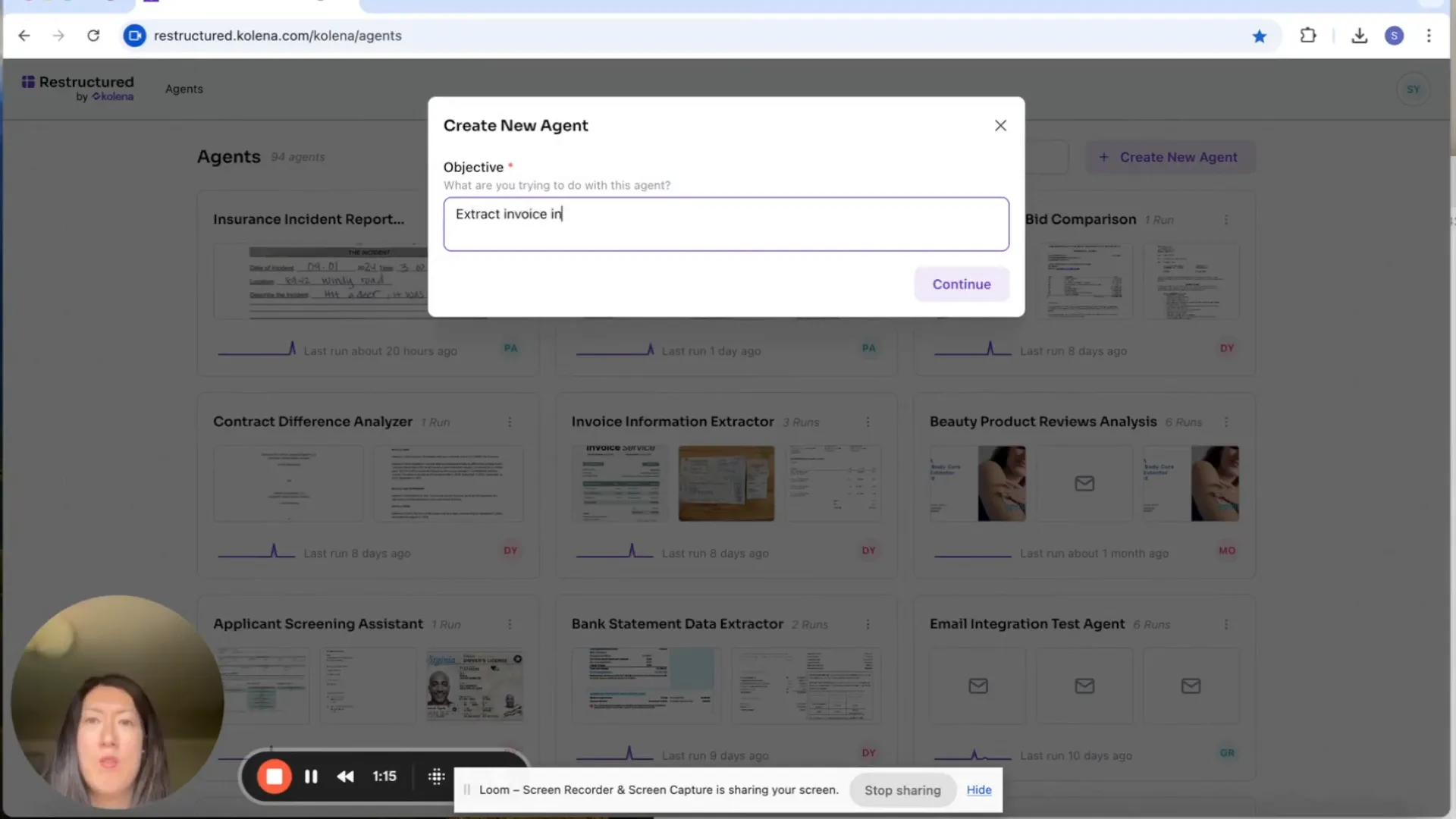

At the core of our solution is the AI agent, designed to function as an intelligent worker. It analyzes data and makes informed decisions based on the context provided. Creating a new agent is straightforward; simply use natural language to define its purpose. For example, you can instruct it to “extract invoice information.” This simplicity makes it accessible for anyone to use.

Setting Up Your Agent

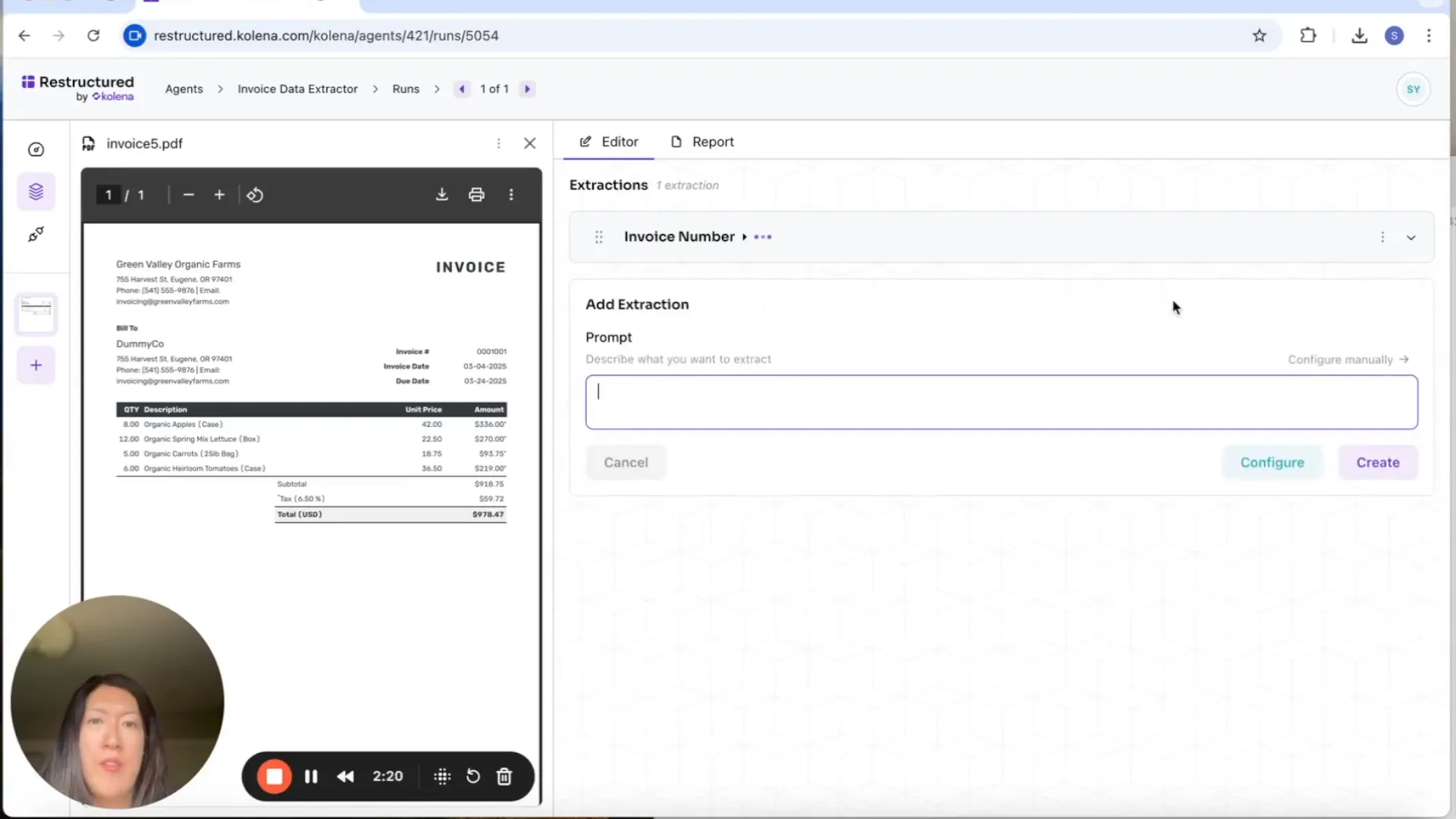

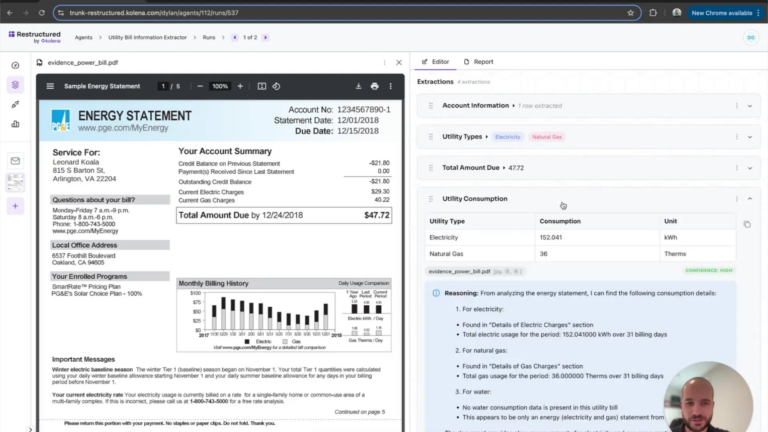

To get started, you’ll need to provide an example file as context. This acts as a template for the AI to learn from. Various file types are supported, including PDFs, scans of handwritten documents, ensuring flexibility in your inputs. Once the agent is created, you can begin specifying the extractions you want to make from your invoices.

Key Extractions to Consider

- Invoice Number: This is vital for tracking purposes.

- Supplier Name: Essential for identifying who the invoice is from.

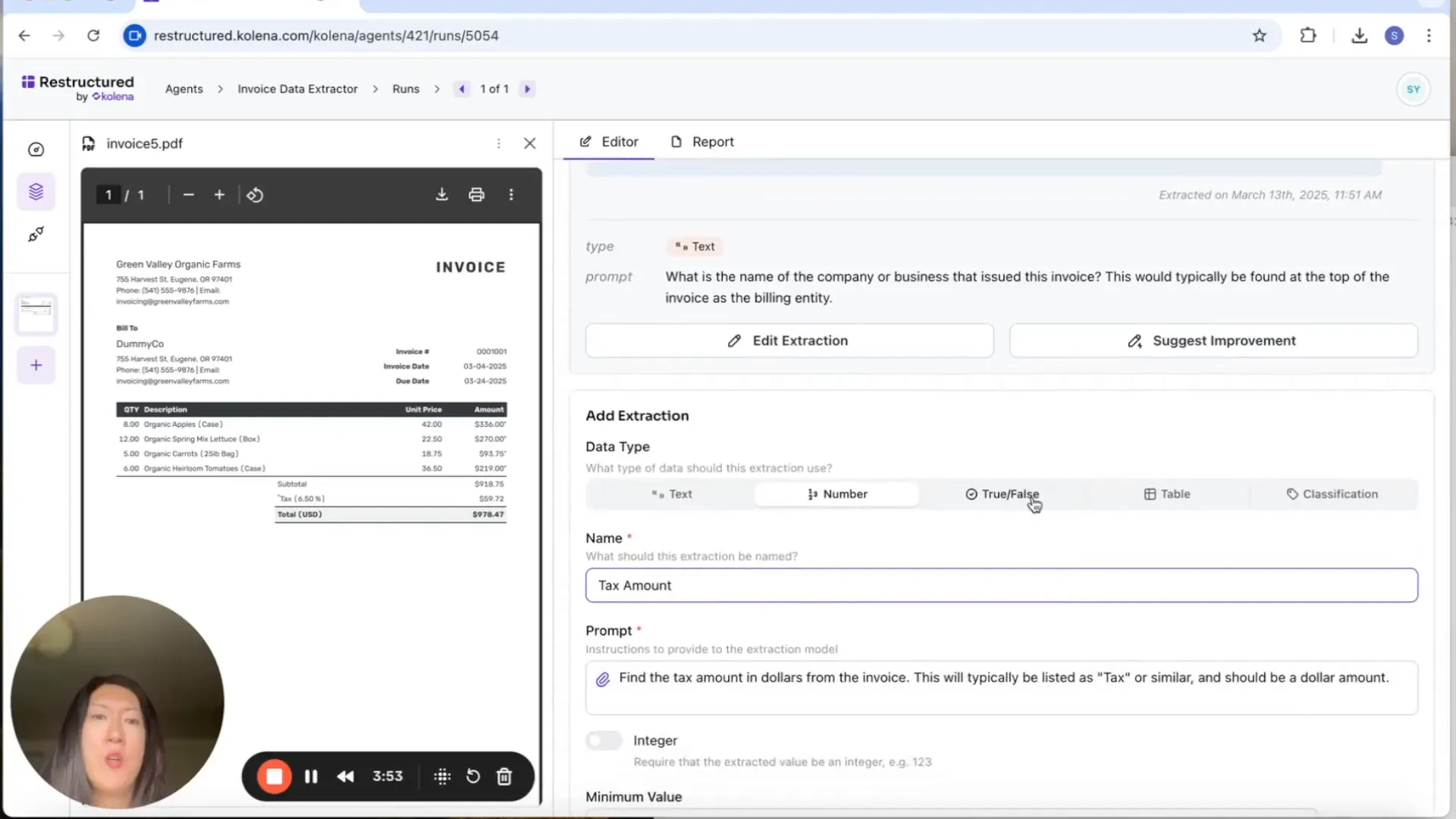

- Tax Information: Understand whether tax is applicable and at what rate.

- Product Type or Category: Classify invoices based on the goods or services provided.

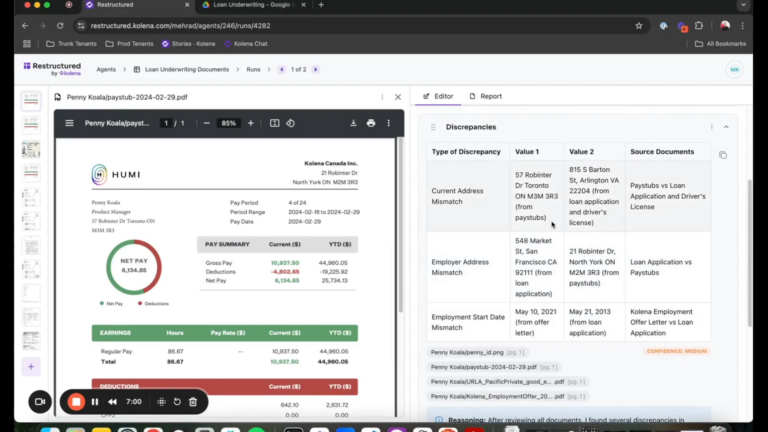

The AI will refine prompts based on the information you provide, allowing for tailored data extraction that evolves over time. For instance, if you want to determine whether tax is applicable, the AI can be instructed to identify invoices with or without tax.

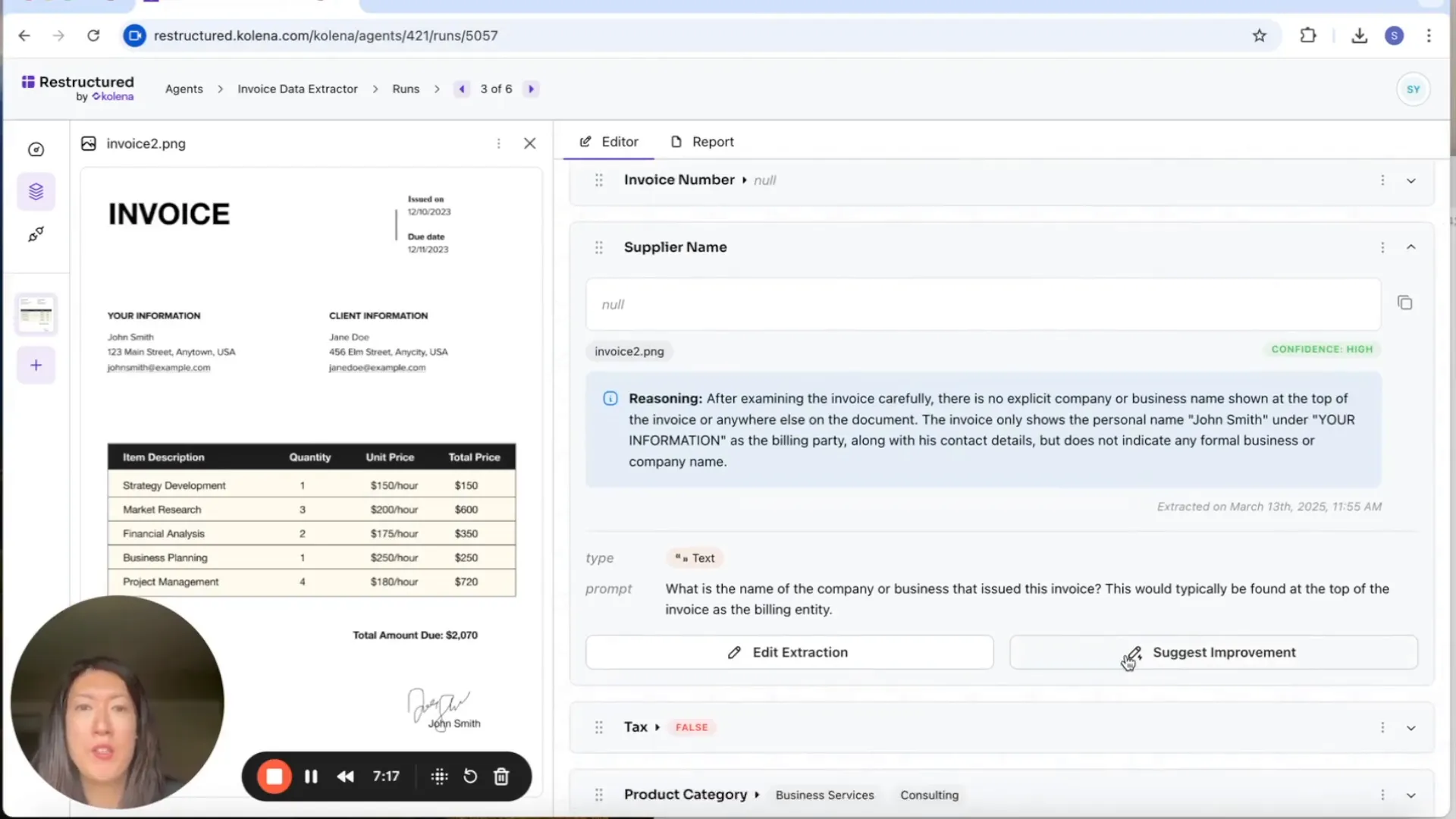

Real-Time Invoice Processing

As you upload additional invoices, the AI processes them in real-time. This capability ensures that information is populated quickly, reducing the need for manual oversight. You can easily verify the extracted data, ensuring accuracy in the records.

Improving Data Accuracy

During the verification process, if you encounter vague or contradictory terms, there’s an opportunity to suggest improvements. For example, if “client information” is ambiguous, you might suggest that it be considered as the “supplier.” This iterative feedback loop enhances the AI’s learning and accuracy over time.

Enhancing Calculations

In addition to extracting information, the AI can also perform calculations. For instance, if the total amount on an invoice is missing, the AI can calculate this based on the provided line items. This feature not only ensures accuracy but also saves time during the reconciliation process.

Conclusion

AI-driven invoice management is transforming how organizations handle their financial operations. By automating the manual labor involved in invoice processing, businesses can save time, reduce errors, and focus on more strategic initiatives. If you’re ready to streamline your invoice workflow and enhance accuracy, consider leveraging AI tools to revolutionize your approach to invoice management.

For more information on how to automate your business with AI agents, visit Automate Your Business with AI Agents – Kolena.

Stay connected with us on LinkedIn and check out our resources on YouTube.