Loan underwriting is a critical process in the financial sector, where detailed assessments are made to evaluate the risk of lending money to applicants. By leveraging loan underwriting with AI, organizations can automate complex workflows, improve efficiency, and gain deeper insights from unstructured financial data. This guide walks through how to set up an AI agent for loan underwriting using Kolena, a no-code AI agent creation platform.

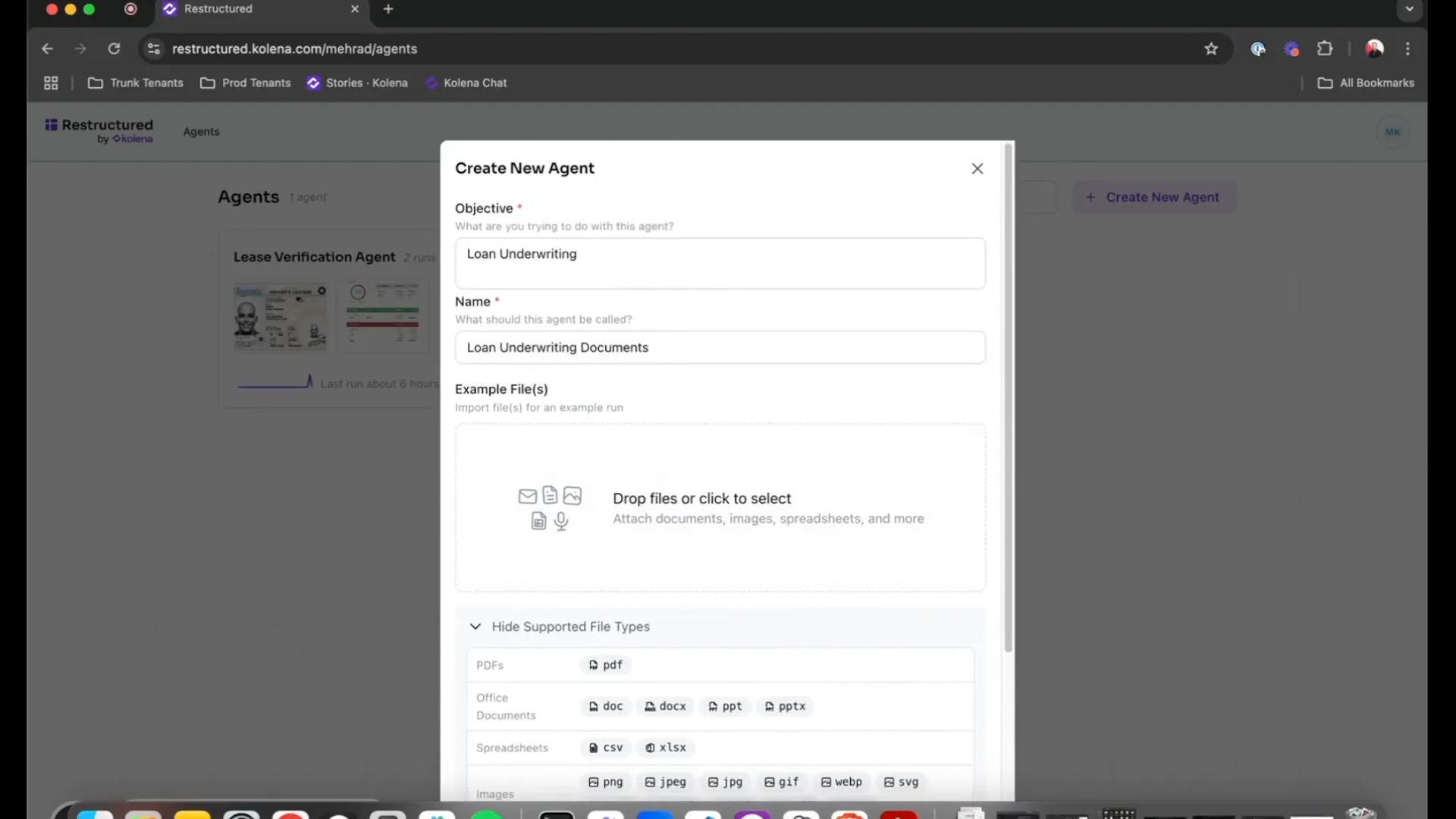

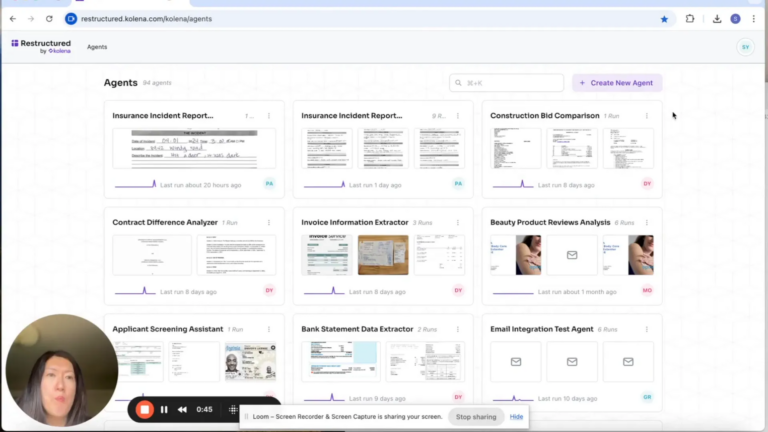

Creating Your AI Underwriting Agent

To kick things off, we start by creating an AI agent specifically for loan underwriting. We’ll name this agent “Loan Underwriting.” This name sets the agent’s persona, dictating its language style and capabilities. The next step is to provide the agent with sample documents, which will help in executing the tasks we want it to perform.

Kolena supports many document types including docs, pdfs, scanned documents – even ones that are hand-written. In this demo, we simply dragged a (fake) loan application onto this agent. Once the documents are uploaded, we proceed to the next steps of defining tasks for the agent.

Defining Tasks for Your Agent

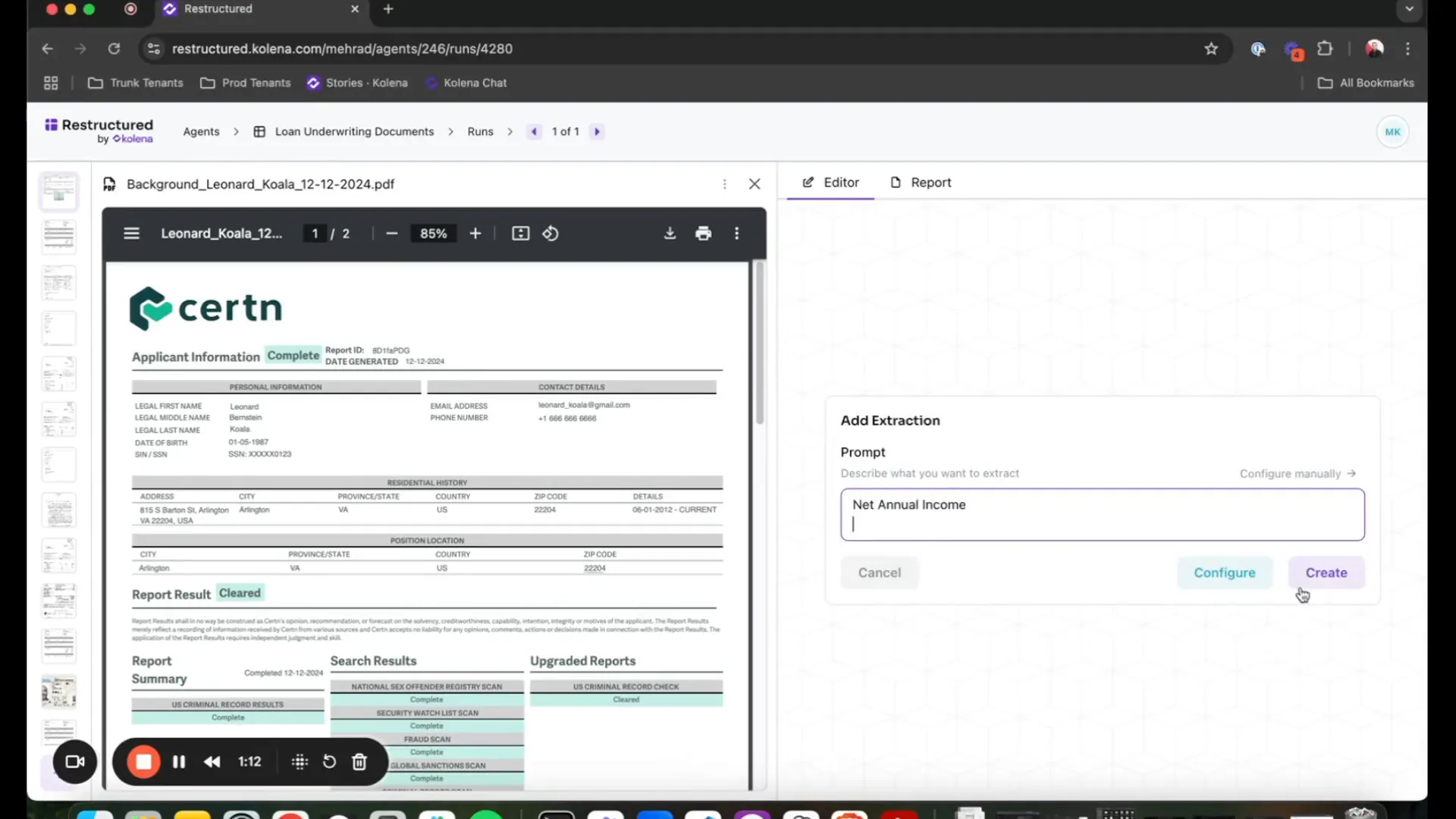

The first task we want to assign is to determine the net annual income of the applicant. The beauty of this tool is that you don’t need to be a prompt engineer; you provide general instructions, and the tool will convert that into a detailed prompt for the agent to execute. In this example, we simply typed in “net annual income” and the AI self-generated this more detailed prompt that ensures better accuracy:

Calculate the annual net income based on the most recent pay stub information. Look for “Current Earnings” and multiply by the number of pay periods in a year based on the pay frequency (e.g., semi-monthly = 24 periods). For semi-monthly frequency, multiply the current earnings by 24.

Next, we ask the agent to check if the applicant has a credit score above 700 and to ensure that the income matches across the provided documents. This step highlights a powerful feature of the Kolena platform: the ability to provide additional resources to the agent for specific tasks. For instance, I can instruct it to verify if all required documents are provided by the applicant using a checklist that I’ve created and uploaded to the AI.

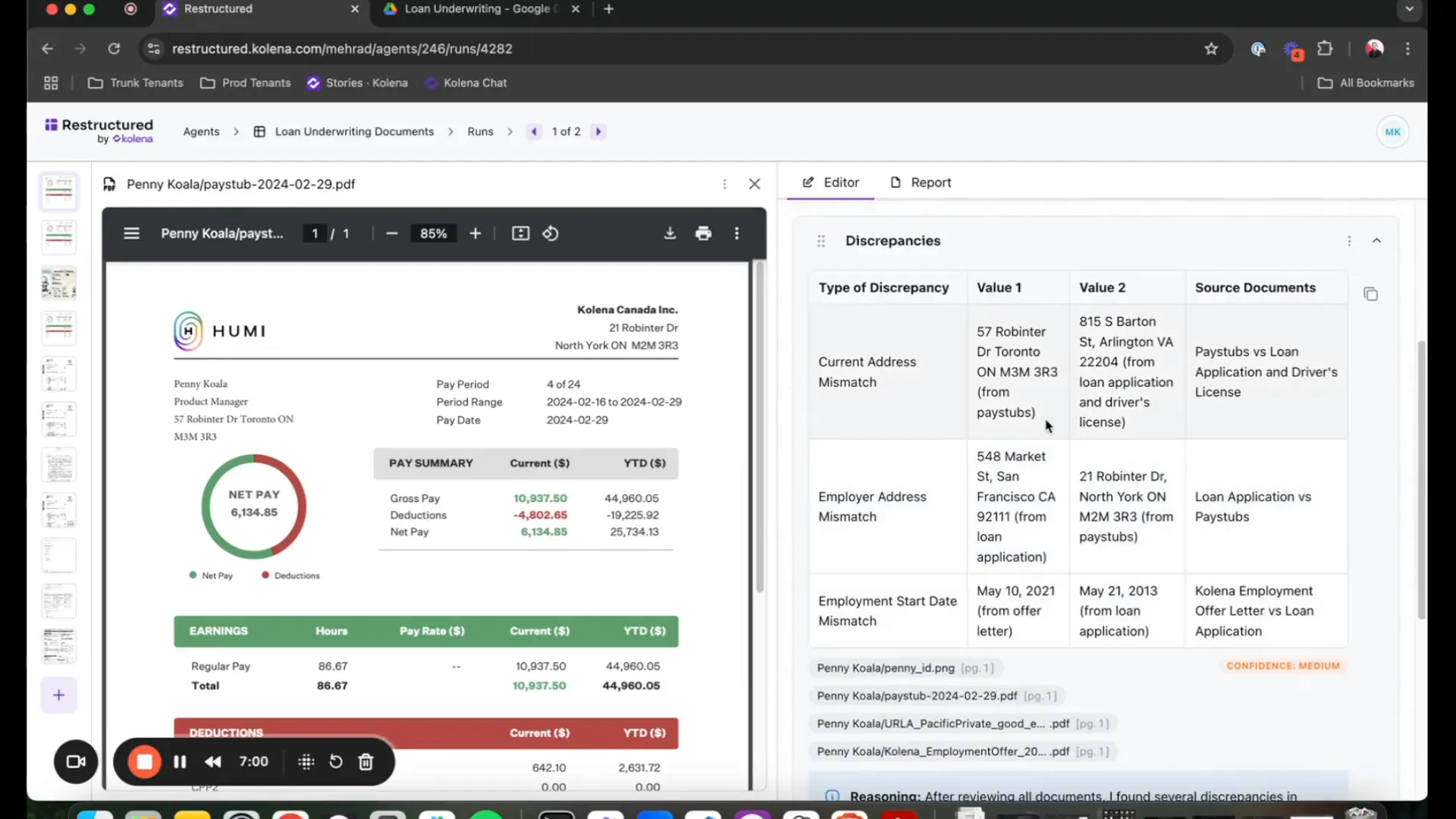

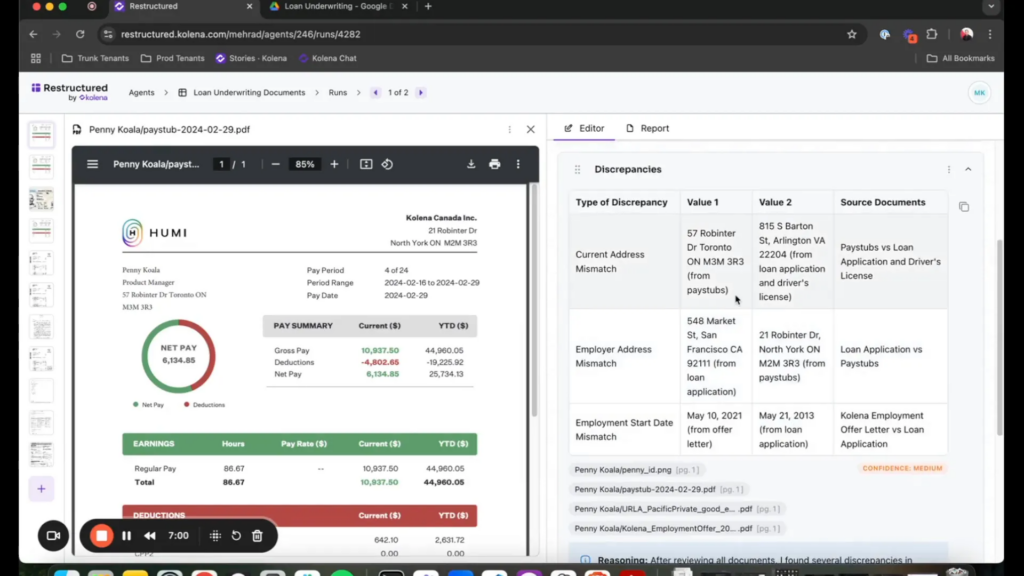

While the agent performs these tasks, we can also find any discrepancies across the loan application with the simple prompt: “table of discrepancies”. This table will list any inconsistencies found across the application.

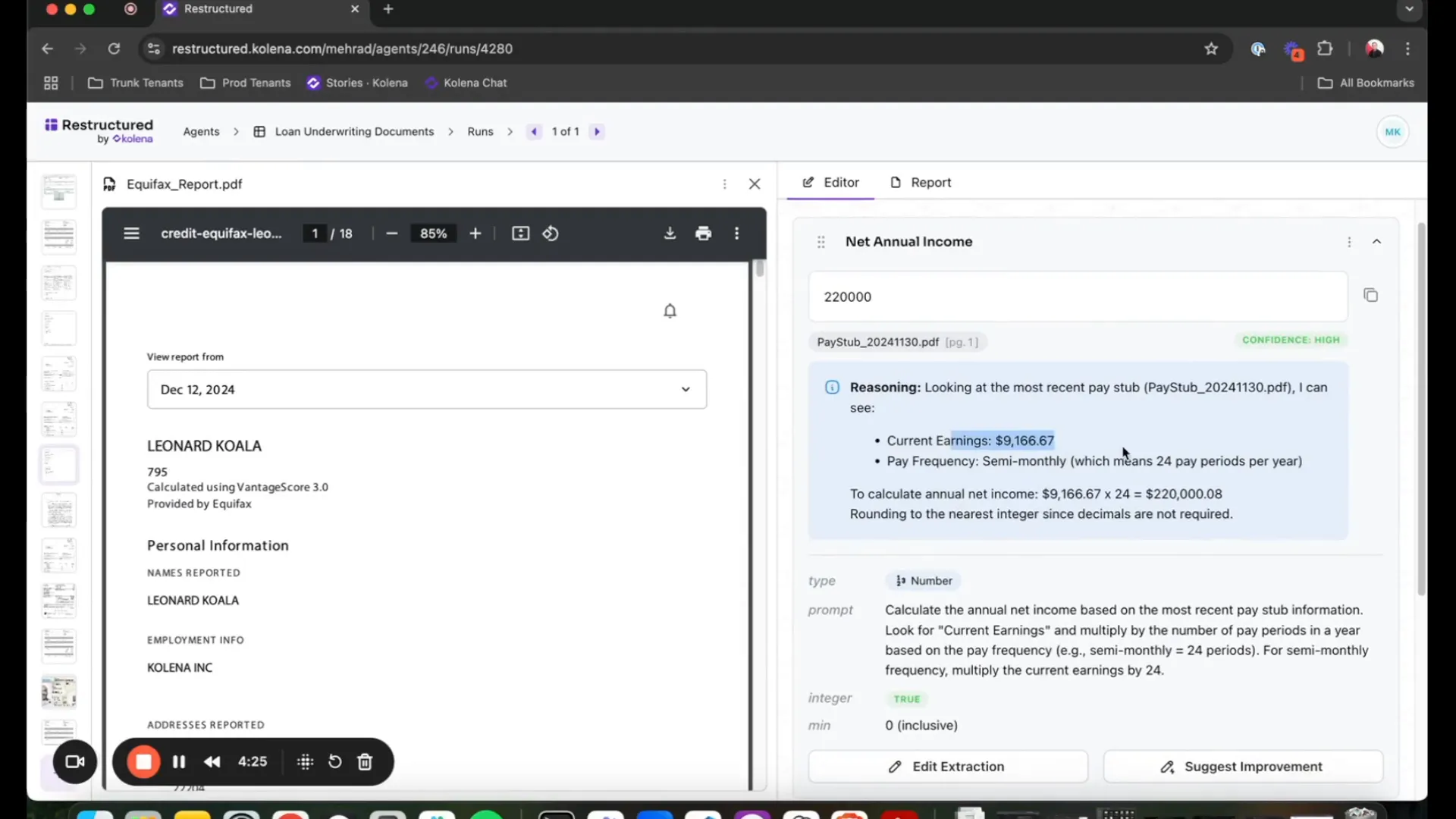

Reviewing Agent Outputs

Once the tasks are completed, we can review the agent’s work. For example, when asking for the annual income, the agent demonstrates its capability to understand the details of the file. It recognizes that the income is reported semi-monthly and multiplies it by 24 to compute the total annual income.

The agent provides us with the resoning for its calculation. In this case, it says:

Reasoning: Looking at the most recent pay stub (PayStub_20241130.pdf), I can see:• Current Earnings: $9,166.67• Pay Frequency: Semi-monthly (which means 24 pay periods per year)To calculate annual net income: $9,166.67 x 24 = $220,000.08Rounding to the nearest integer since decimals are not required.

This level of reasoning allows for double-checking the agent’s work, and all extractions come with citations from the files used for calculations. The agent can also analyze multiple credit reports to check for accuracy.

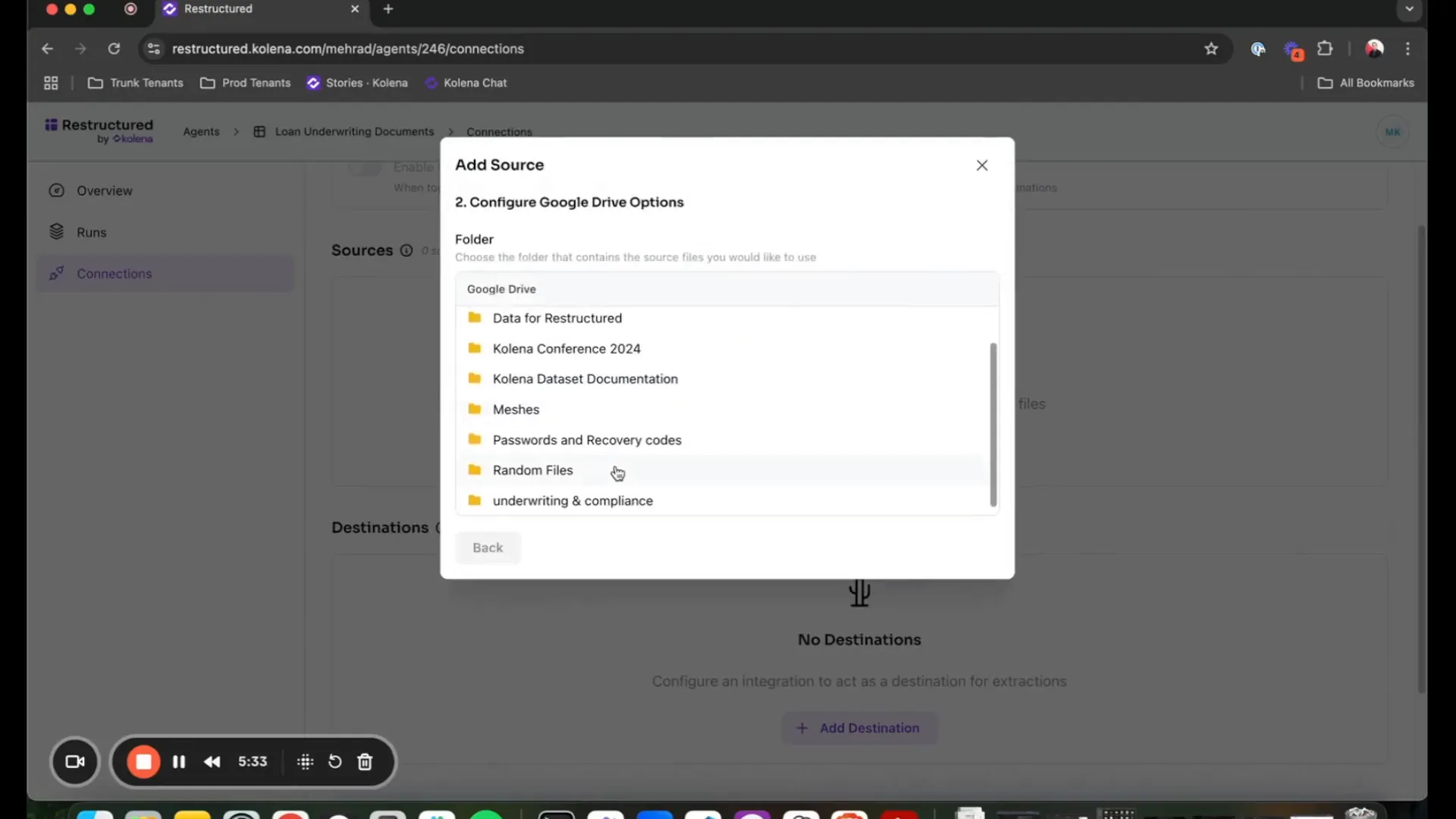

Integrating with Google Drive

With the agent and its tasks clearly defined, we can create connections to various sources. For instance, we can connect it to Google Drive, so that each time a new application is added, the agent can automatically fetch and process that application.

After selecting the folder for loan applications, the agent is now configured to listen for new applications. We can add a new zip file with a fresh application into that folder, and upon returning to our platform, we can see the new application being processed in real-time.

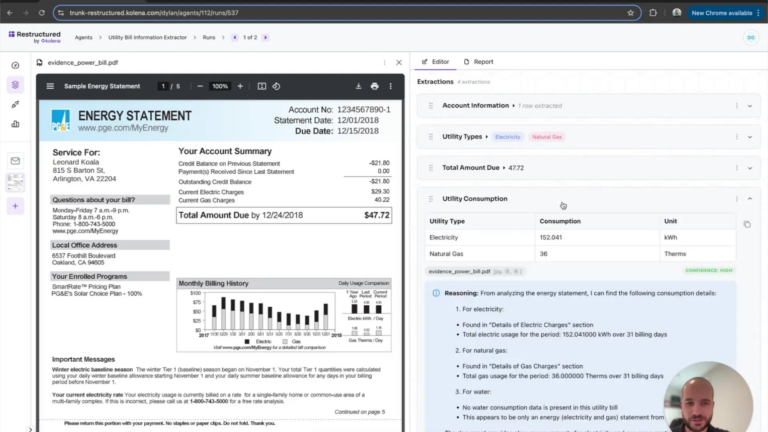

Handling Different Document Formats

The agent is format-agnostic. It can handle various types of documents, whether they are scanned files or different structures. This flexibility ensures that the agent extracts all necessary information according to the predefined template.

Each time the agent completes a task, it generates a report outlining individual tasks, outcomes, reasoning, and all details required for the underwriting process. This report can be printed or shared with colleagues, ensuring everyone is on the same page.

Conclusion

The integration of AI into loan underwriting is transforming how financial institutions assess risk and make informed decisions. By setting up an AI agent, organizations can streamline their workflows, reduce human errors, and enhance the overall efficiency of the underwriting process.

For more information on how to automate your business with AI agents, check out Kolena. Stay connected with us on LinkedIn and explore further insights on our YouTube channel.